Navigating Organization Risks with Bagley Risk Management

Navigating Organization Risks with Bagley Risk Management

Blog Article

How Livestock Danger Security (LRP) Insurance Policy Can Protect Your Livestock Investment

In the world of animals investments, mitigating threats is paramount to making certain economic stability and growth. Livestock Danger Defense (LRP) insurance policy stands as a reliable shield against the unforeseeable nature of the market, providing a tactical approach to protecting your assets. By delving right into the details of LRP insurance and its diverse advantages, livestock manufacturers can strengthen their financial investments with a layer of protection that transcends market variations. As we check out the realm of LRP insurance, its role in protecting livestock investments becomes significantly noticeable, guaranteeing a course towards sustainable financial strength in an unpredictable market.

Recognizing Livestock Risk Security (LRP) Insurance

Comprehending Livestock Risk Defense (LRP) Insurance policy is essential for animals producers seeking to alleviate financial dangers connected with rate variations. LRP is a government subsidized insurance policy product developed to shield producers against a decrease in market costs. By supplying insurance coverage for market value decreases, LRP aids manufacturers secure a flooring cost for their animals, making sure a minimum level of earnings despite market variations.

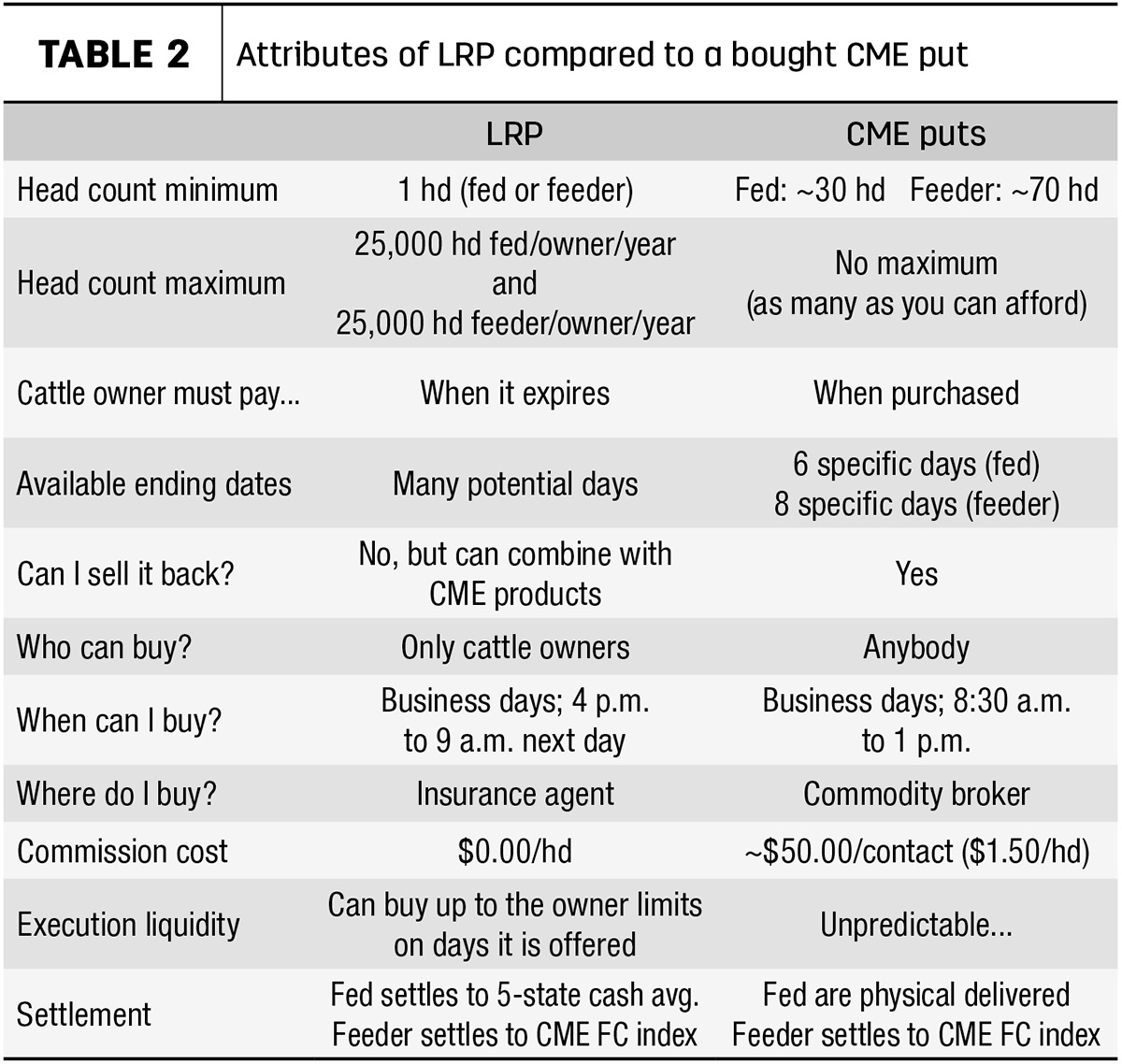

One trick element of LRP is its versatility, permitting manufacturers to personalize insurance coverage levels and policy lengths to fit their certain requirements. Producers can select the variety of head, weight array, insurance coverage price, and coverage duration that align with their production goals and run the risk of tolerance. Understanding these adjustable choices is crucial for manufacturers to properly handle their rate threat direct exposure.

Moreover, LRP is readily available for numerous animals kinds, including livestock, swine, and lamb, making it a versatile threat management tool for animals manufacturers throughout various sectors. Bagley Risk Management. By acquainting themselves with the complexities of LRP, producers can make enlightened choices to guard their investments and ensure economic security in the face of market unpredictabilities

Advantages of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Animals Risk Defense (LRP) Insurance policy gain a calculated benefit in shielding their financial investments from cost volatility and safeguarding a secure economic footing among market unpredictabilities. One crucial benefit of LRP Insurance is price security. By setting a floor on the price of their animals, manufacturers can reduce the threat of significant economic losses in the occasion of market slumps. This enables them to prepare their budget plans a lot more properly and make notified decisions regarding their operations without the constant concern of price changes.

Moreover, LRP Insurance policy gives producers with peace of mind. Generally, the advantages of LRP Insurance policy for livestock manufacturers are considerable, providing a beneficial device for managing danger and ensuring financial security in an unforeseeable market environment.

Exactly How LRP Insurance Coverage Mitigates Market Dangers

Minimizing market threats, Livestock Threat Defense (LRP) Insurance offers livestock producers with a reputable shield versus rate volatility and monetary uncertainties. By using protection versus unanticipated rate drops, LRP Insurance policy aids manufacturers secure their investments and preserve financial stability in the face of market changes. This type of insurance coverage allows animals manufacturers to lock in a cost for their animals at the beginning of the plan duration, ensuring a minimal rate degree no matter market modifications.

Steps to Safeguard Your Animals Financial Investment With LRP

In the realm of agricultural threat monitoring, applying Animals Threat Protection (LRP) Insurance involves a critical procedure to guard financial investments against market fluctuations and unpredictabilities. To protect your animals investment effectively with LRP, the primary step is to examine the details risks your procedure deals with, such as cost volatility or unexpected weather condition occasions. Understanding these dangers allows you to determine the insurance coverage level needed to shield your investment adequately. Next, it is vital to study and select a trustworthy insurance coverage provider that offers LRP plans customized to your animals and business demands. Carefully review the policy terms, conditions, and protection restrictions to ensure they straighten with your threat monitoring goals once webpage you have chosen a carrier. In addition, regularly monitoring market patterns and adjusting your coverage as needed can help maximize your defense against possible losses. By complying with these actions carefully, you can boost the security of your livestock investment and navigate market uncertainties with confidence.

Long-Term Financial Safety And Security With LRP Insurance Coverage

Making certain withstanding financial security with the application of Livestock Danger Protection (LRP) Insurance policy is a sensible long-term strategy for farming manufacturers. By incorporating LRP Insurance policy right into their threat monitoring strategies, farmers can guard their livestock investments versus unforeseen market changes and damaging occasions that can threaten their financial health in time.

One trick advantage of LRP Insurance coverage for long-lasting economic protection is the satisfaction it offers. With a reliable insurance plan in position, farmers can alleviate the economic dangers connected with volatile market conditions and unanticipated losses because of factors such as disease episodes or all-natural calamities - Bagley Risk Management. This security permits manufacturers to focus on the day-to-day operations of their livestock company without constant bother with possible economic troubles

Additionally, LRP Insurance policy offers a structured strategy to managing threat over the long term. By establishing websites certain coverage levels and choosing proper endorsement periods, farmers can customize their insurance policy prepares to align with their monetary goals and risk resistance, making certain a sustainable and protected future for their animals operations. To conclude, buying LRP Insurance coverage is a positive strategy for agricultural manufacturers to achieve long-term monetary safety and security and secure their source of incomes.

Final Thought

In conclusion, Livestock Risk Security (LRP) Insurance is a beneficial tool for livestock producers to mitigate market dangers and safeguard their financial investments. It is a smart choice for safeguarding livestock investments.

Report this page